INCREASE in government expenditure on wage bill and health care has widened the country’s fiscal deficit projected to remain elevated at more than 10.0 percent of GDP in 2021.

business

March 24, 2021

NEO SENOKO

3 min read

Govt spending widens fiscal deficit

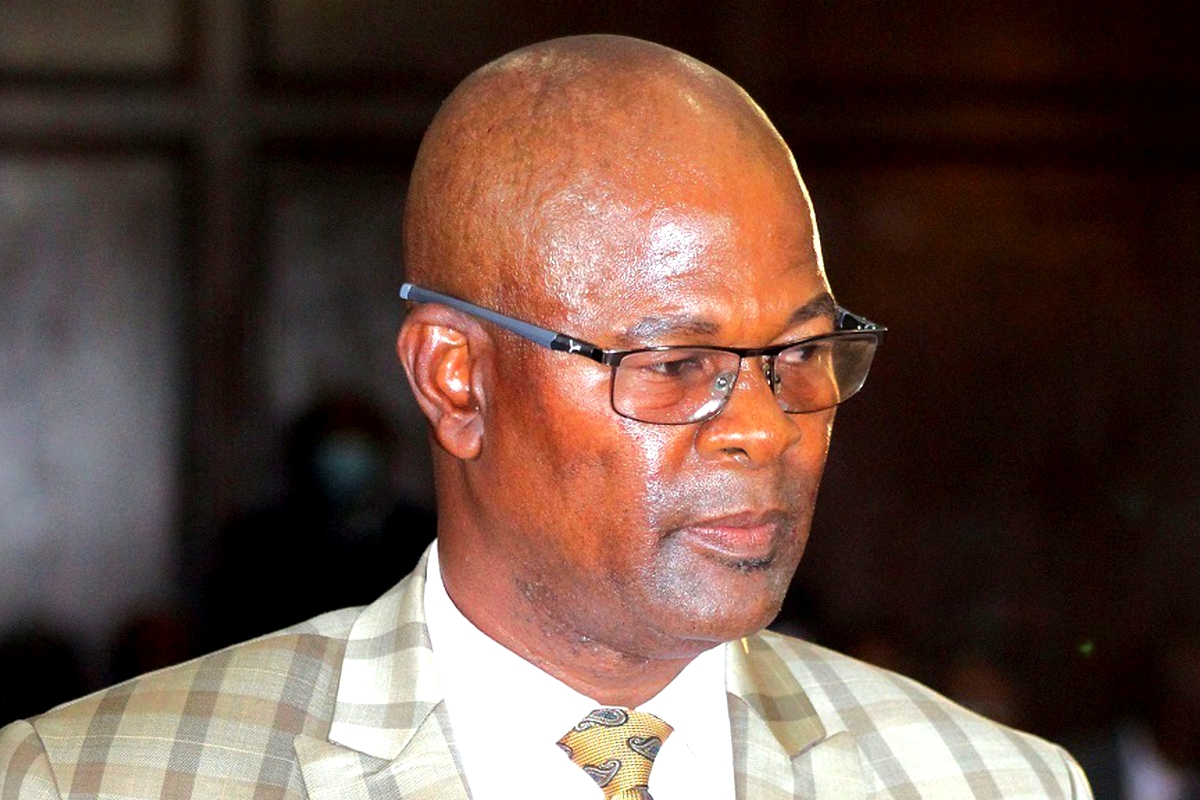

The Minister of Finance Thabo Sophonea

This is largely due to massive health related spending owing to the COVID-19 pandemic, along with high expenditures on wage bill as well as the imminent decline in the Southern African Customs Union (SACU) revenue collections because of the weak economic activity in the region.

The current account deficit is also projected to deteriorate further to 8.6 percent later this year, reflecting low external demand and dwindling incomes and transfers from migrants in South Africa.

As a result, the country’s total public debt is scheduled to increase to 62.8 percent of GDP due to the pandemic, breaching the South African Development Community (SADC) convergence criterion of 60 percent of GDP.

This is according to the 2021 edition of the African Economic Outlook released last week.

The report focuses on debt resolution, governance and growth in Africa. It reveals that the decline in imports from South Africa contributed to food shortages in Lesotho, fueling inflationary pressures.

Hence, inflation was estimated to decline only marginally to 5.0 percent in 2020 from 5.2 percent the previous year.

“The fiscal deficit was estimated to widen to 10.0 percent of GDP in 2020 from 5.6 percent in 2019, largely driven by a 25 percent increase in government expenditures mainly on the wage bill and government spending on health care to fight the pandemic.

“Much of the financing gap is expected to be met through foreign borrowing, unless the government undertakes substantial fiscal adjustments to curb the widening fiscal deficit and the associated accumulation of foreign debt, which could threaten debt sustainability,” the report stated.

External debt stood at 36.1 percent of GDP in 2020, well below the convergence criterion of 60 percent of GDP set by SADC.

In 2021 however, total public debt is projected to increase to 62.8 percent of GDP, breaching the SADC convergence criterion of 60 percent. The country’s risk of external debt distress has, therefore, been revised from low in 2019 to moderate.

Enjoy our daily newsletter from today

Access exclusive newsletters, along with previews of new media releases.

“Going forward, Lesotho needs capacity strengthening for domestic resource mobilisation, drawing down reserves, renegotiating debt, attracting concessionary financing, deploying remittances for infrastructure development, and fiscal consolidation to reduce the wage bill from its current level of 24 percent of GDP. The textile industry needs to source inputs from alternative countries to alleviate overdependence on China,” the report added.

Lesotho’s wage bill is three times the average for sub-Saharan Africa.

Among some if its expenditure policy measures, the government through the Minister of Finance, Thabo Sophonea revealed during the 2021 budget speech that the employment policy will be revised to reduce the high wage bill. Parastatals salaries will also be reviewed with the purpose of standardizing them.

The ministry has also promised to start negotiations for a medium term International Monetary Fund (IMF) programme to address the long existing structural problems that will help to restore macroeconomic stability.

The decline in exports to both South Africa and the United States and reduced investments from China and South Africa, coupled with dwindling incomes and transfers, led to a deterioration in the current account deficit from 6.0 percent of GDP in 2019 to 7.2 percent in 2020.

The widening current account deficit also reflected a 26.6 percent decline in diamond exports and a 21.2 percent decline in textile exports.

Tailored for you