MARKETING and promotions giant, LeseliHub has been given the green light by both the Central Bank of Lesotho (CBL) and the Ministry of Trade and Industry to issue a total of 150 000 ordinary shares to the general public.

business

Aug. 18, 2021

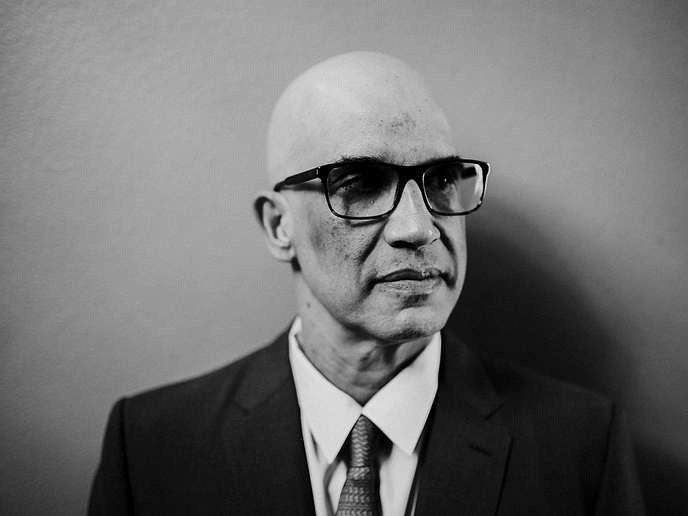

NEO SENOKO

3 min read

LeseliHub offers shares to public

One of Leselihub's billboards

The public offer, according to the company, seeks to raise in aggregate a total equity amount of M31 million and is open between August 2 - February 1, 2022.

“The prospectus relates to an invitation to citizens of Lesotho and non-citizens to subscribe for up to 150 000 ordinary shares in LeseliHub at the issue price of M206.67 per share. The make-up of this issue price can be illustrated in the following:

“Intrinsic share value price of M199.88 plus share premium of M6.76 is thus equal to the share issue price of M206.67,” the company said in its prospectus.

The minimum subscription required for participation by an applicant in this offer is 10 shares, which amounts to a subscription payment of M2 066.67 and the maximum amount for subscription is 1 000 shares, amounting to subscription payment of M206 666.67.

LeseliHub is a local specialised marketing and promotions company that has enjoyed an exponential growth since 2013 while mainly dealing in outdoor advertising, specifically billboards.

If the total equity raised through the public offer is less than M5 million, then the public offer will not be implemented in terms of Section 117(2) and (3) of the Companies Act.

If after the closing date, the minimum subscription amount has not been exceeded, all contributions made shall be repaid within a period of 90 days in terms of Section 117(4) of the Act.

But if the total equity raised in the public offer is equal to or greater than M5 million, but below M31 million, the public offer will still be deemed successful.

With the aim of becoming the industry leader in Lesotho and southern Africa in the next five to 10 years, leading with quality and innovative marketing and advertising services, the company wishes to offer shares to the public in furtherance of the achievement of this goal.

“The need for investment capital is the reason why the public is invited to buy shares from LeseliHub and subsequently have a hand in its anticipated dynamic growth which will be immensely rewarding in return,” the company further showed.

Upon raising the envisaged investment capital, the company says the plan is to build, within a period of three to five years, an additional 200 billboards in all 10 districts of Lesotho, taking its cumulative infrastructure number to 242 billboards, all ranging from the sizes of 6m x 3m, 12m x 3m and 18m x 3m.

Enjoy our daily newsletter from today

Access exclusive newsletters, along with previews of new media releases.

About 60 percent of these billboards will cater for local clientele, 30 percent for South African clientele while 10 percent shall be for clientele in countries other than Lesotho and South Africa.

“Our eight to 10-year plan is to expand into the Southern African Development Community (SADC) region and build a total of 1 000 billboards (10 percent digital) throughout all SADC countries. Further to this, move into the entire African continent with our focus on highly populated African regions, thereby building up to a minimum of 10 000 billboards throughout the entire African continent in a period of 15 to 20 years,” the company added.

It further noted that, subject to any agreement or restriction binding the company from time to time, any declaration of dividend for each financial year shall be determined by shareholders in the annual general meeting upon the advice of the board, having taken into account the profits in the company available for distribution after appropriation of prudent and proper reserves including allowance for future working capital, provision for tax, interest payments and repayments of amounts borrowed.

While the directors do not provide any assurance of the future level of dividends to be paid by the company, and while it also intends to retain future earnings to fund the development and growth of the business, the payment of dividends will be reviewed every five years commencing from the date of the success of the offer.

Tailored for you