JOHANNESBURG – South Africa’s Reserve Bank’s Monetary Policy Committee (MPC) has again left the repo rate unchanged at its lowest level since it was introduced in 1998 – a unanimous decision by all of the committee’s five members.

business

May 21, 2021

STAFF REPORTER

5 min read

Reserve Bank holds repo rate at 3.5%

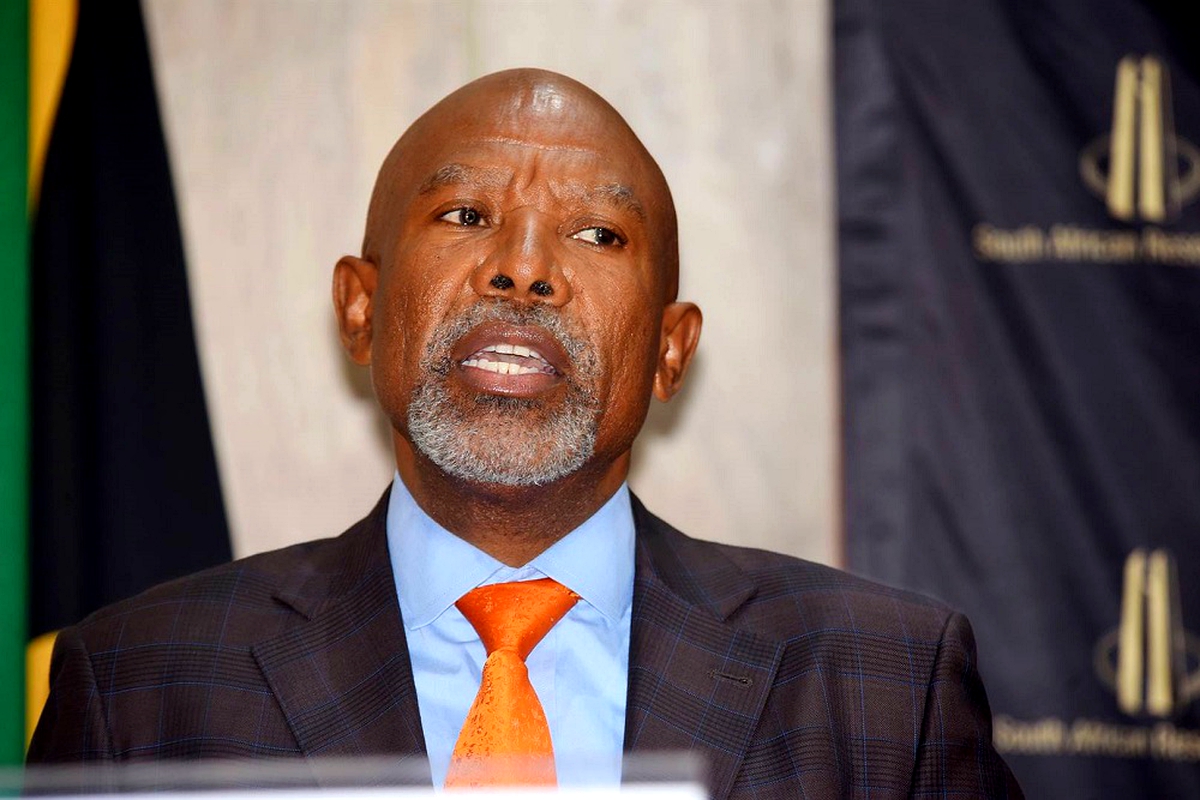

SA Reserve Bank’s Governor, Lesetja Kganyago

The Reserve Bank’s Governor, Lesetja Kganyago, announced the decision on Thursday, to keep the repo rate at 3.5 percent, where it has been since July 2020. This is the third time in 2021 that the majority of MPC members voted to keep the repo rate unchanged at its bimonthly rates deliberation meeting.

Kganyago believes the bank’s monetary policy is still “accommodative” and that “there was no need to adjust policy at the meeting” as South Africa’s weak economy “could do with support”.

Keeping interest rates low is the main tool the bank can use to support the economy and financially distressed consumers. However, the bank’s model suggests two hikes (each of 25 basis points) during 2021.

BNP Paribas economist Jeffrey Schultz expects interest rates to start rising in November 2021 – compared with an earlier projection of January 2022 – mainly due to an improved economic recovery after many sectors of the economy reopened under eased lockdown regulations.

Iraj Abedian, a senior economist at Pan-African Investment and Research Services, said the bank has no reason to change its monetary policy stance for as long as global central banks are still helping economies get through the COVID-19 pandemic.

“The big central banks are still in a money printing mode and have not started tapering [support for economies]. For as long as money is being printed in major economies, central banks in emerging markets have no reason to start increasing interest rates,” said Abedian.

The Reserve Bank has upgraded economic growth forecasts for 2021 and expects consumer inflation risks, which inform the bank’s interest rate decision, to be contained over the same period. The decision by the Reserve Bank was largely expected, as not one of the 19 economists surveyed by Bloomberg ahead of the MPC decision expected a change in the repo rate or its stance to its monetary policy approach.

The COVID-19 pandemic and lockdowns from late March 2020 have seen the bank deliver a combined 300 basis points cut, bringing the prime lending rate for consumers to 7%. The bank has to balance supporting a fragile economy and keeping rising consumer inflation in check.

Inflation and the rand

The bank’s MPC tracks inflation patterns to keep economic growth steady and prices stable. A report by Statistics South Africa on Wednesday showed that consumer inflation accelerated sharply to 4.4 percent year on year in April, from 3.2 percent in March.

This was the highest inflation level in 14 months or since February 2020, when it reached 4.6 percent ahead of the COVID-19 lockdown.

Inflation is within the midpoint of the bank’s 3-6 percent target range. The bank expects headline consumer inflation to average 4.2 percent in 2021, up from 3.3 percent in 2020. Headline consumer inflation is forecast to average 4.4 percent in 2022 and 4.5 percent in 2023.

One of the factors that supported the argument for the bank to keep the repo rate unchanged is the rand’s gains against the US dollar. Since the last MPC meeting in March, the rand has gained just more than 7 percent against the dollar. The bank isn’t worried about the currency driving up inflation.

Economic growth

The first quarter 2021 GDP reading, which is scheduled to be released by Stats SA on 8 June 2021, is expected to be positive.

Key economic data such as mining and manufacturing production, which both contribute more than 20 percent to South Africa’s economic output, rose slightly in the three months through March 2021, compared with the previous quarter.

Enjoy our daily newsletter from today

Access exclusive newsletters, along with previews of new media releases.

The bank expects the first-quarter growth to be 2.7 percent, which is stronger than the 0.2 percent contraction expected at the last MPC meeting in March. For 2021 as a whole, the central bank expects the economy to grow by 4.2 percent, up from its estimate of 3.8 percent in March.

“The stronger growth forecast for 2021 reflects better sectoral growth performances and more robust terms of trade in the first quarter of this year,” said Kganyago during his delivery of the MPC statement.

“Despite rising oil prices and a higher total import bill, commodity prices have risen to new highs, strengthening income gains to the economy. Household spending is expected to be healthy this year, in line with the easing of lockdown restrictions and low interest rates.”

Kganyago said getting back to prepandemic economic output levels “will take time”.

The central bank expects GDP to grow 2.3 percent in 2022 and 2.4 percent in 2023. DM/BM

Tailored for you