THE incessant decline in economic activity in the textile and clothing along with construction and mining industries is drastically affecting domestic economy and will continue to do so over the period between 2021 and 2022.

business

Sept. 25, 2020

NEO SENOKO

3 min read

Economic performance declines by 12.6%

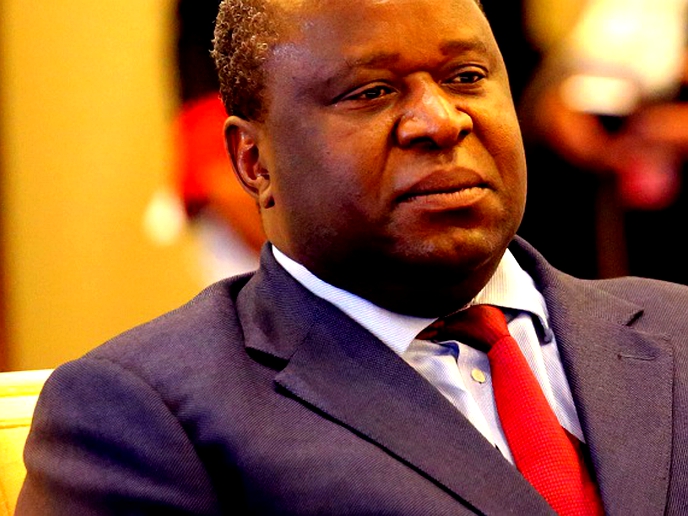

CBL Governor Dr Retšelisitsoe Matlanyane

This is according to the Central Bank of Lesotho (CBL) Monetary Policy Committee (MPC) during its quarterly meeting on Tuesday.

The CBL Governor Dr Retšelisitsoe Matlanyane said during the meeting that domestic economic performance in the second quarter of 2020 fell drastically by 12.6 per cent.

Forecasting in to the next quarter, she warned that domestic economy is projected to contract by 6.4 per cent this year due to the economic fallout of the COVID-19 pandemic.

In the same quarter, the rate of inflation, as measured by year-on-year percentage change in consumer price index (CPI) increased from 5.6 per cent in July to 6.0 per cent in August.

“This was mainly due to an increase in the prices of food and non-alcoholic beverages and clothing and footwear. In the medium term, the economy is projected to recover gradually and grow at an average growth rate of 4.6 per cent over the period 2021 to 2022,” Dr Matlanyane said.

In terms of the outlook, the annual inflation rate is projected to register 5.1 per cent this year before increasing to 5.2 and 5.4 per cent in 2021 and 2022 respectively.

Having considered the Net International Reserve (NIR) developments and outlook, regional inflation and interest rate outlook, domestic economic conditions and the global economic outlook, the MPC decided to decrease the NIR target floor from US$550 million to US$540 million.

Enjoy our daily newsletter from today

Access exclusive newsletters, along with previews of new media releases.

The NIR target remains consistent with the maintenance of the exchange rate peg between the loti and the South African rand.

“The CBL has continued to emphasize that preserving adequate reserves to guarantee the peg is of paramount importance, given the fixed exchange rate’s role as the key anchor of macroeconomic stability. Within the constraints of the exchange rate peg, the bank has taken various measures to support the economy during this difficult time,” Dr Matlanyane added.

On the other hand, the committee decided to maintain the CBL rate at a rate of 3.50 per cent per annum. The rate, set at this level, will ensure that the domestic cost of borrowing and lending remain aligned with the cost of funds elsewhere in the region.

The MPC further reported that money supply, as measured by M2, increased by 1.1 per cent in July, following a decline of 1.7 percent in June.

The increase was due to a rise in net foreign assets, which was moderated by a softening in net domestic asserts. Private sector credit improved marginally by 0.5 per cent between June and July compared to a decrease of 4.0 percent in June.

The balance of payments position on the other hand improved in the second quarter, on account of an increased surplus on the secondary income account together with a reduced deficit on the services account. Consequently, gross international reserves rose to 6.5 months of import cover from 4.7 months in the previous quarter.

Tailored for you