MASERU - The Commissioner General of the Lesotho Revenue Authority (LRA), Thabo Khasipe, and his South African counterpart Edward Kieswetter, have signed a Memorandum of Understanding (MOU) on Processing and Administering the Value Added Tax (VAT) Refund System.

business

Nov. 25, 2019

OWN CORRESPONDENT

2 min read

LRA enters new pact with SARS

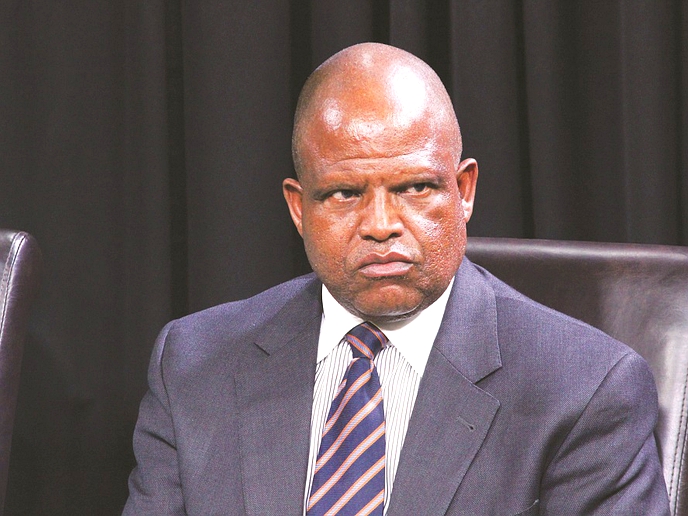

LRA boss Thabo Khasipe

According to a press release issued by LRA, the signing took place in Kampala, Uganda on the sidelines of the 4th African Tax Administration Forum (ATAF') International Conference on Tax in Africa (ITCA) between November 18 and 21.

The main objective of the MOU is to set up procedural aspects relating to refunds of VAT on import or export of goods between Lesotho and South Africa.

LRA states that the key issues covered by the MOU include amongst others; refund procedures, lists of ports designated either as commercial or non-commercial, detailed description of '‘tax invoices'’, obligations of the two Revenue Administrations and requirements for structured meetings to ensure that issues, challenges and opportunities arising out of the operation of the VAT refund arrangement are dealt with.

It shows that the signing of the MOU will pave the way for unlocking potential benefits and to deal with more important issues to the two countries. The operationalising of the MOU, in line with the respective domestic laws and the VAT Agreement, will allow the LRA and the South African Revenue Services (SARS) to set up strategies to deal with non-compliance and VAT fraud schemes and set up mechanisms for VAT refunds in relation to services and e-commerce.

Enjoy our daily newsletter from today

Access exclusive newsletters, along with previews of new media releases.

Both tax administrations are also expected to exchange information, assist in collections and resolutions of difficulties and disputes.

The statement shows that the MOU forms part of a bilateral requirement under Lesotho and South Africa (9th March 2014) “Agreement on Mutual Assistance and Co-operation and the Prevention of Fiscal Evasion with Respect to Value Added Tax” (The VAT Agreement) Article 3 (4).

The MOU has been under negotiations for a couple of years. The negotiations and progress thereof were influenced and affected by the practical issues that were being experienced by the two revenue administrations in relation to the VAT refund system that was in place, based on the cordial cooperation that has always been in place ever since Lesotho introduced VAT.

Tailored for you