MASERU – Business tycoon Lebuajoang Simon Thebe-ea-Khale has revealed his plan to invest billions of Maloti in property development around the country, with the construction of more than 10 shopping malls and centres in the pipeline across all the districts of Lesotho.

news

Jan. 17, 2020

KABELO MASOABI

3 min read

MKM resurrection: Thebe-ea-Khale to build 10 malls

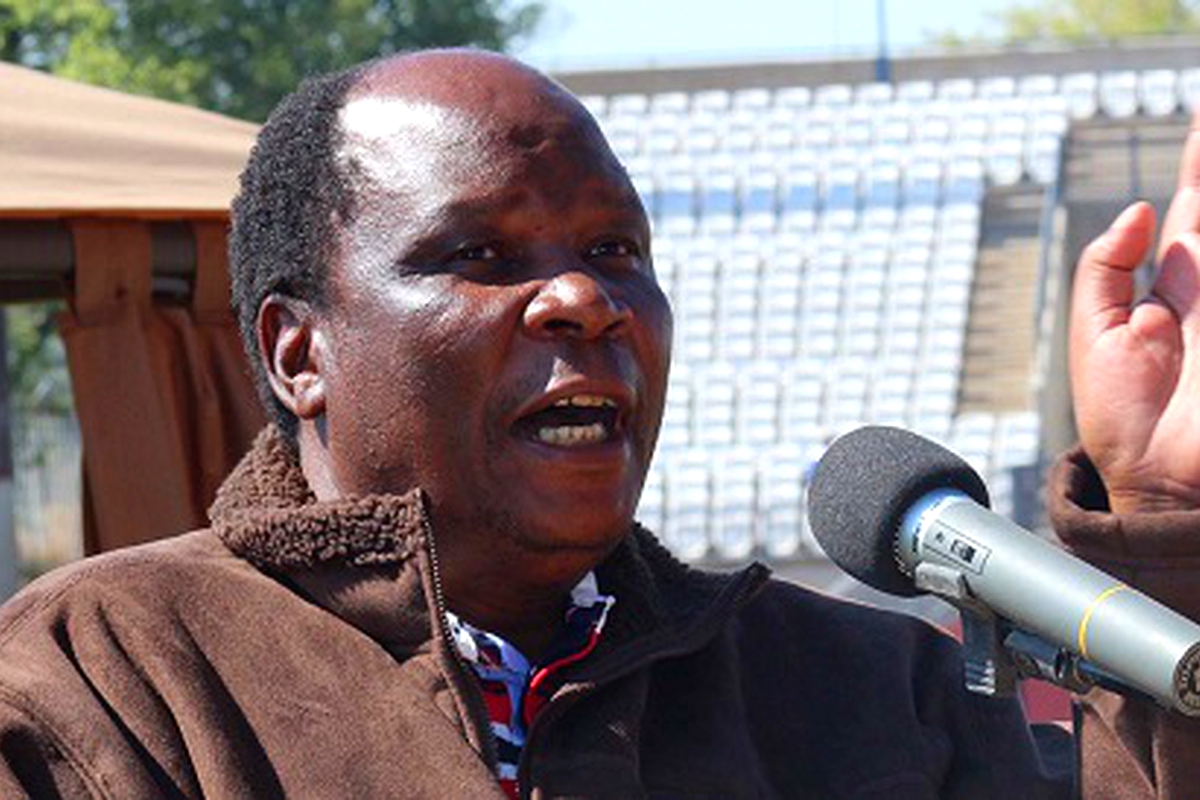

Business tycoon Lebuajoang Simon Thebe-ea-Khale

Mr Thebe-ea-Khale announced this during the launch of yet another of his initiatives, Ha Re Thusaneng Limited Company on Tuesday; which he said was purposed to raise funds for the erection of the malls and other projects.

Consultant architect and managing director of Trend Group Architects and Design, Lenka Mphafi, led the sod turning clearing for the construction of the first mall to be positioned in Lifariking, Khubetsoana, in the Berea district, where the business mogul had initially mulled construction of a mortuary, crematory facility and private cemetery.

According to Mr Mphafi, the mall which is expected to cost well over a billion maloti is designed to be a five-level structure, with other attached structures to offer rental space for government and other offices, run two fuel garages, have a medical clinic, factory outlets, amphitheater, rental houses and other essential facilities.

Enjoy our daily newsletter from today

Access exclusive newsletters, along with previews of new media releases.

“We are a company that has built most of Ntate Sam Matekane’s buildings, including his business centre (MGC Park) near the Maseru Correctional Facility sports ground, and also did renovation work on his Mpilo Boutique Hotel to give it a more appealing look. We also built his Mpilo Estate, which is situated above the ’Manthabiseng Convention Centre to mention but a few from our experience. We are going to change this place of Ntate Thebe-ea-Khale,” boasted Mr Mphafi.

For his part, Mr Thebe-ea-Khale further revealed that there were more than 40 projects in the pipeline and among other projected developments were a mine, a state-of-the-art hospital, a hotel and a chain of factories.

“All these will be attained through this investment scheme opportunity that we are launching today. I appeal to Basotho to take advantage of this open venture meant to uplift their lives for good.

“Assisted by a team of professional people I am working with, I have managed to secure investors from parts of South Africa, Botswana and Zimbabwe who are going to inject millions into these projects,” he explained to thousands attending clients of the new scheme in Lifariking.

“We waited for 13 years to resurrect after the government liquidated our business, MKM. This is the resurrection of MKM now that the High Court has ordered that our properties be returned to us. The court has ordered the Master of High Court to convene the first creditors meeting before end of March 2020.

“Our company is coming back to us at an exciting period that coincides with this launch today of another bigger and better company, Ha Re Thusaneng,” explained MKM creditors committee chairperson Tšeliso Manyeli.

The penny-wise Thebe-ea-Khale was at some point probably one of the richest men in Lesotho with more than 60 properties and more than 200 vehicles registered under his name.

Records show that between 2001 and 2007 when the Central Bank of Lesotho (CBL) eventually shut down MKM, the latter had gone on a spending spree that saw him amassing a huge property portfolio.

Investigators hired by CBL found that Mr Thebe-ea-Khale had little regard for proper corporate governance and had habits of a spend-thrift even with the investors’ monies.

For instance, there was little distinction between what belonged to MKM and what Thebe-ea-Khale himself owned, the auditors found.

The bulk of the latter’s properties were most likely found to have been acquired through depositors funds, while others were not even properly registered either under his name or that of his companies.

The CBL discovered that MKM was operating insurance business without a license and that its main operations were reflective of a Ponzi scheme.

Thousands of Basotho could not access their invested monies during the period of liquidation.

Tailored for you