LESOTHO’s external debt is expected to maintain an upward trajectory, surging from 42.5 to 43.9 percent in 2022, says the International Monetary Fund (IMF) in its latest regional economic outlook report.

business

May 6, 2022

NEO SENOKO

2 min read

Lesotho debt to surge 44 percent

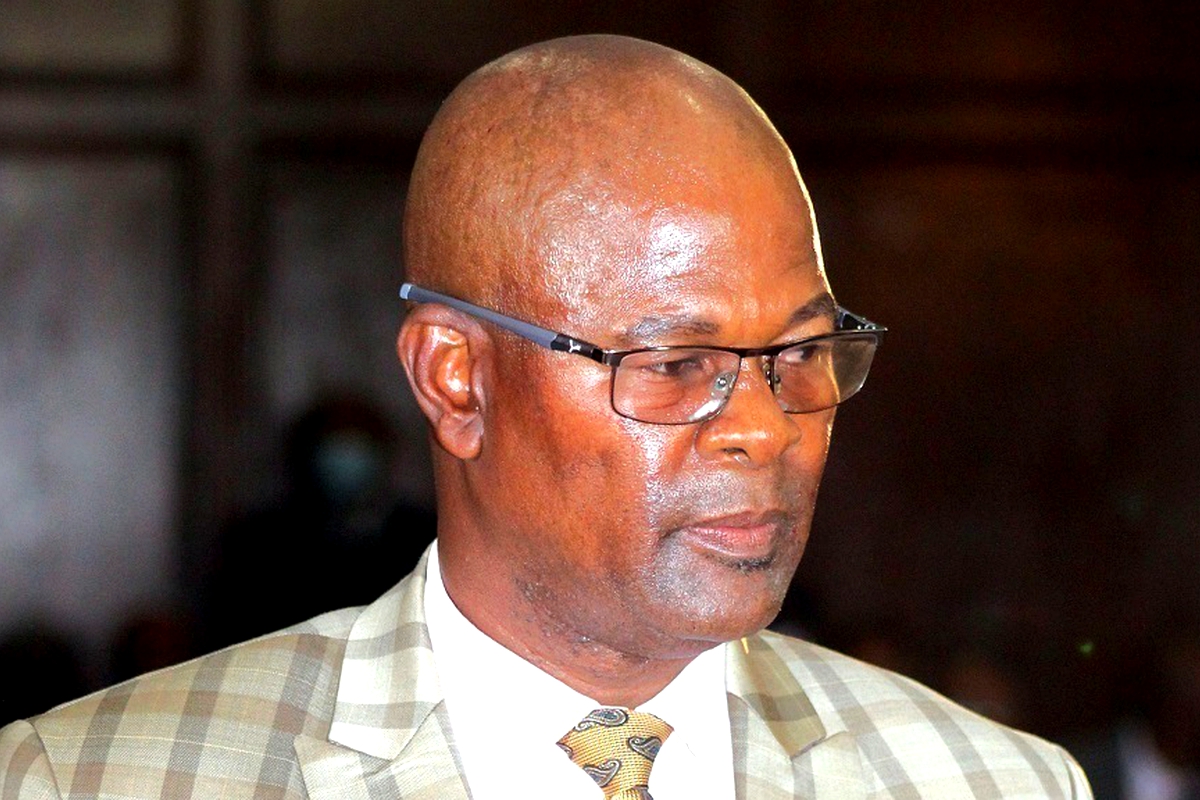

Minister of Finance, Thabo Sophonea

Story highlights

In 2023, the external debt will skyrocket again from 43.9 to 45.2 percent.

Although the regional economy was on the upside in the second half of 2021, the IMF said progress had been jeopardised this year due to external shocks such as the Russia and Ukraine war, amongst others.

“The Russian invasion of Ukraine has triggered a global economic shock that is hitting the region at a time when countries’ policy space to respond is minimal to nonexistent,” said the IMF.

“Most notable, surging oil and food prices are straining the external and fiscal balances of commodity-importing countries and have increased food security concerns in many countries. High food prices will disproportionately harm the most vulnerable segments of the population, especially in urban areas.”

For countries with the most pressing debt vulnerability like Lesotho, the IMF said direct budget support through grant financing would be critical.

It said the recent international shocks were likely to have significant implications for the macro-economic outlook in the region. Notably, the ongoing US monetary policy tightening that is worsening external financing conditions.

Earlier this year, the Minister of Finance, Thabo Sophonea said a total government debt as of February 2022 stood at M18 billion, made up of external debt of M15.5 billion and domestic debt of M3.4 billion.

“The main drivers of the increase in external debt are movements in major currency exchange rates such as the US Dollar, the Euro and other Basket of currencies against Loti, while the domestic debt is mainly driven by the persistent high budget deficits,” he said when delivering his budget presentation for the fiscal year 2022/23.

“Lesotho remains at the moderate level of debt distress with a limited borrowing space.”

Enjoy our daily newsletter from today

Access exclusive newsletters, along with previews of new media releases.

He said a combination of treasury bonds estimated at M1 billion and Treasury-Bills amounting to M400 million would be auctioned to deepen and continue a path of building a functionally vibrant domestic debt market and to finance the government financing gap estimated at M1.4 billion.

Despite the projected tough conditions, the IMF said the recent launch of the African Continental Free Trade Area (AfCFTA) marked a milestone towards deeper regional integration.

It said the agreement had the potential to eliminate tariffs on 90 percent of existing intraregional trade flows and critically to reduce non-tariff barriers that were continuing to undermine regional competitiveness.

Deeper integration would boost incomes, create jobs, catalyse foreign direct investment and facilitate the development of regional supply chains.

The AfCFTA would need to be implemented swiftly and complemented by an enabling macroeconomic environment and a range of structural reforms to deliver its full potential.