Many people are wondering, "Does FTX still exist?" It is a question that pops up quite a bit, especially when you think about what happened in the world of digital money. For a while, FTX was a very big name, a major player in the space where people trade digital currencies. It seemed like it was everywhere, honestly, and had a lot of support. So, to be honest, the idea of it just vanishing can be a bit confusing for many folks.

You see, this question comes up because the events around FTX were quite dramatic. It was a situation that really shook things up, not just for those who used the platform, but for the entire digital currency market. When something so prominent goes through such a significant change, people naturally want to know what the current situation is. It's like asking about a building that was once very tall but then had to be taken down; you want to know if it's still there or if something else stands in its place, you know?

This article will look at what happened to FTX and explain its current state. We will explore the journey of this digital exchange, from its rise to its very public fall. We will also talk about what this means for anyone who had money or assets there, and what the future might hold, if anything, for the name FTX. It is a story that, in a way, has many layers, and we will try to make it clear for you.

Table of Contents

- What Was FTX, Anyway?

- The Big Crash: What Went Wrong?

- So, Does FTX Still Exist?

- What Happens Next for FTX?

- Lessons Learned from the FTX Saga

- Frequently Asked Questions About FTX

What Was FTX, Anyway?

FTX, at one point, was a really popular place for buying and selling digital currencies. It was a digital exchange, a platform where users could trade various crypto assets, like Bitcoin or Ethereum, and even more complex financial products tied to them. The company started in 2019, and it grew incredibly fast, almost unbelievably fast, in just a few years.

It was known for its quick trading speeds and a wide range of options for users. Many people, from casual investors to seasoned traders, used FTX for their digital currency activities. The platform, in some respects, aimed to be a leader in the digital finance space. It also had a lot of big-name endorsements and partnerships, which really helped it gain a lot of trust and visibility, you know?

The company's founder, Sam Bankman-Fried, was a very public figure. He often spoke about the future of digital currencies and seemed to be everywhere. FTX also had a sister company, Alameda Research, which was a trading firm. These two entities, basically, worked very closely together. This setup, as a matter of fact, played a big role in what happened later on.

The Big Crash: What Went Wrong?

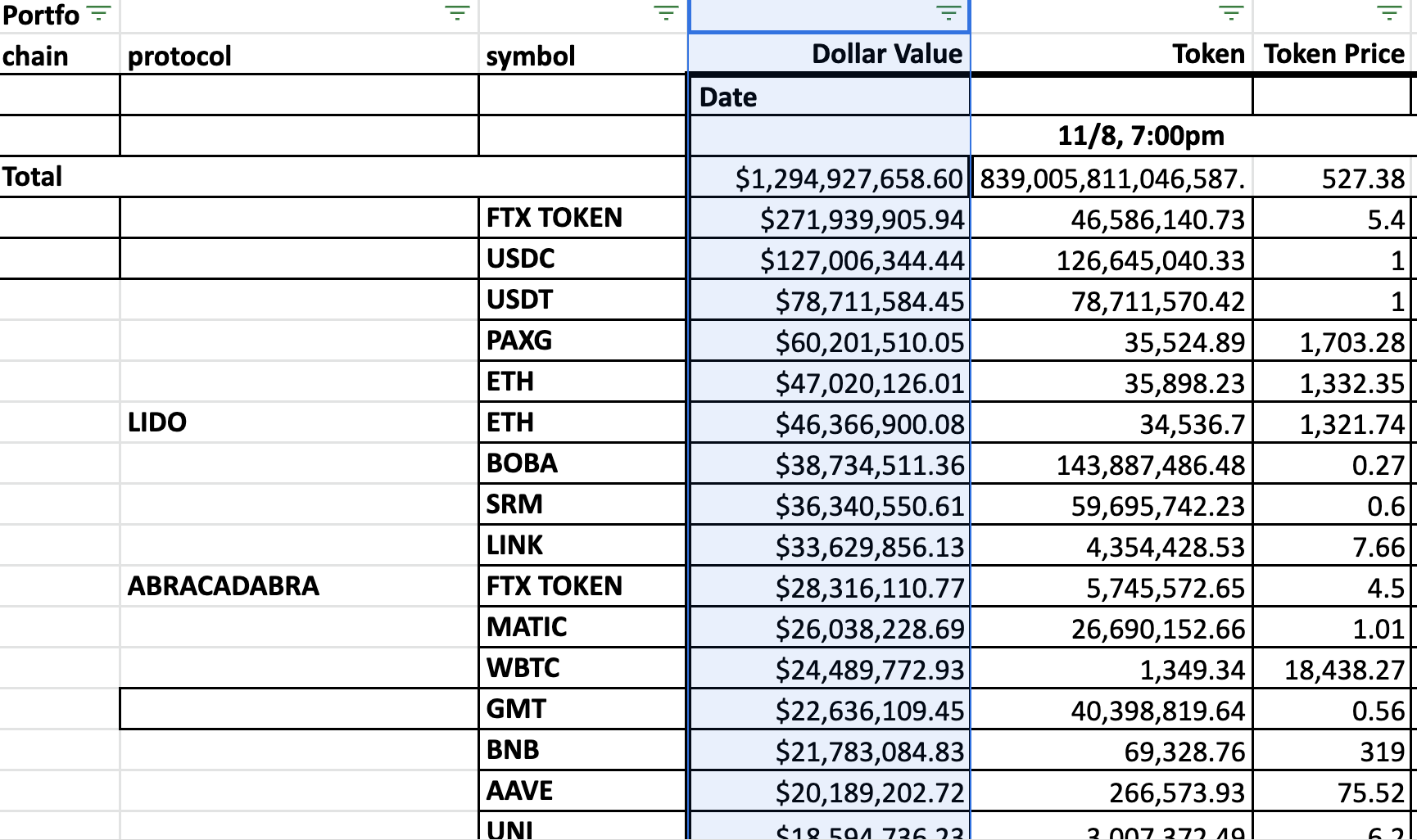

The issues with FTX became very public in November 2022. It was a rather sudden turn of events that caught many people by surprise. Reports started coming out that Alameda Research, the trading firm linked to FTX, held a large amount of its assets in FTT, which was FTX's own digital token. This kind of arrangement, in a way, raised some concerns among those who watch the market closely.

Then, a competing exchange, Binance, announced it would sell all of its FTT tokens. This announcement, frankly, caused a lot of worry among investors. People started pulling their money out of FTX very quickly. This sudden rush to withdraw funds is often called a "bank run" in the traditional finance world, and it happened to FTX, too. The platform just could not handle all the requests for withdrawals.

It became clear that FTX did not have enough actual money or other assets to cover all the user withdrawals. It was a serious problem. The company had, apparently, lent a significant amount of its customer funds to Alameda Research, which then used those funds for risky investments. When those investments did not pay off, and users wanted their money back, FTX found itself in a very difficult spot. This situation, in fact, led to the company stopping all withdrawals, which was a huge shock to everyone involved.

So, Does FTX Still Exist?

The straightforward answer to "Does FTX still exist?" is no, not in the way it once did. The company, FTX Trading Ltd., filed for bankruptcy protection in the United States on November 11, 2022. This action essentially means the company stopped its normal operations. It is no longer an active platform for trading digital currencies. You cannot, for example, log in and buy or sell crypto there today, you know?

When a company files for bankruptcy, it usually means a court takes over to manage its remaining assets and debts. This process aims to fairly distribute any remaining value to the people or entities that are owed money. For FTX, this means a new team, led by John Ray III, took control to oversee the bankruptcy proceedings. He has a lot of experience with large, complex bankruptcies, like the one involving Enron, which was a very big case.

So, while the legal entity "FTX Trading Ltd." still exists in a bankruptcy court, the operational exchange, the place where you could trade digital money, does not. It is, basically, shut down. Any talk about FTX now refers to the ongoing legal and financial process of trying to recover assets and pay back creditors. It is not about a functioning trading platform anymore, which is that key difference.

What Happens Next for FTX?

The process for FTX now involves a lot of legal work and financial recovery efforts. The new management team is working to find all the assets FTX had, which is a rather complex task. They are trying to figure out exactly how much money was lost and where it all went. This includes looking for digital assets, bank accounts, and any other property the company might have owned. It is a bit like trying to put together a very large, complicated puzzle, you know?

The main goal of the bankruptcy process is to get as much money back as possible for the people and companies that FTX owed. These are called creditors, and they include former customers who had funds on the exchange. There are many steps involved, including selling off remaining assets, settling disputes, and trying to recover funds that might have been improperly used. This whole thing tends to be a very long process, often taking years.

There have been some positive updates in terms of asset recovery. The team managing the bankruptcy has, apparently, managed to locate a significant amount of digital assets and other funds. This is good news for creditors, as it increases the chances that they might get some of their money back. However, it is still uncertain how much each creditor will ultimately receive. It is a situation that is still very much in progress, as a matter of fact.

Lessons Learned from the FTX Saga

The collapse of FTX offers some very clear lessons for anyone involved in digital currencies. One of the biggest takeaways is the importance of understanding where your money is held. When you use a digital currency exchange, you are trusting that platform with your assets. It is not like having money in a traditional bank account, which often has government insurance. Digital currency exchanges usually do not have that kind of protection, you know?

This event also highlights the need for strong regulation in the digital currency space. Many people believe that more oversight could help prevent similar situations from happening again. It is about making sure that exchanges handle customer funds responsibly and are transparent about their financial health. The lack of clear rules, arguably, contributed to the problems at FTX.

For individuals, the FTX situation serves as a powerful reminder to always do your own research. Before putting money into any digital currency platform, it is really important to understand how it works, what risks are involved, and what protections are in place. You should also consider not keeping all your digital assets on an exchange. For more information on keeping your digital assets safe, you can learn more about cryptocurrency safety on our site. It is often a good idea to move funds to a personal digital wallet if you are not actively trading them. To understand more about how these platforms work, you can also link to this page understanding crypto exchanges.

The story of FTX, in some respects, is a stark warning about the risks in a rapidly evolving financial area. It shows that even seemingly robust platforms can face serious challenges. Staying informed and being careful with your digital assets is, basically, always a smart move. You can find more information about ongoing legal proceedings related to FTX on reputable news sources, for example, Reuters has covered it quite extensively.

Frequently Asked Questions About FTX

Is FTX still operating in any form?

No, FTX is not operating as a digital currency exchange anymore. The company filed for bankruptcy in November 2022. Its operations stopped then. The legal entity still exists as part of the bankruptcy process, but you cannot trade digital money on it. It is, basically, shut down for good.

Can I get my money back from FTX?

The process of getting money back from FTX is part of the ongoing bankruptcy proceedings. A team is working to recover assets. They are trying to get funds back for creditors, including former customers. It is a long and complex process, and it is not certain how much money, if any, individual users will get back. You need to follow the official bankruptcy updates, honestly.

What happened to Sam Bankman-Fried?

Sam Bankman-Fried, the founder of FTX, faced legal charges related to the company's collapse. He was arrested and later found guilty of several charges, including fraud and conspiracy. He is currently awaiting sentencing. His case is a very public part of the FTX story, as a matter of fact.

Detail Author:

- Name : Hertha Wuckert II

- Username : uschulist

- Email : oschneider@walker.com

- Birthdate : 2001-03-17

- Address : 4700 Liliane River North Geovanni, IN 17973

- Phone : 1-585-988-5270

- Company : Smitham-Runolfsdottir

- Job : Floor Layer

- Bio : Veritatis sed expedita doloremque aut et quibusdam similique. Non animi velit molestiae. Impedit quo esse non error saepe est ut itaque.

Socials

linkedin:

- url : https://linkedin.com/in/prosacco2016

- username : prosacco2016

- bio : Eaque ipsum consequatur ut.

- followers : 829

- following : 2824

facebook:

- url : https://facebook.com/maxwell_dev

- username : maxwell_dev

- bio : Cumque dolores neque ex quis voluptatem totam dolores.

- followers : 1812

- following : 2801

instagram:

- url : https://instagram.com/prosaccom

- username : prosaccom

- bio : Enim qui nihil et debitis facilis. Temporibus fuga sit id voluptatem tempore perferendis odio.

- followers : 2426

- following : 1296

tiktok:

- url : https://tiktok.com/@maxwell_dev

- username : maxwell_dev

- bio : Vitae eaque rerum tenetur distinctio tenetur autem aut.

- followers : 1441

- following : 1256